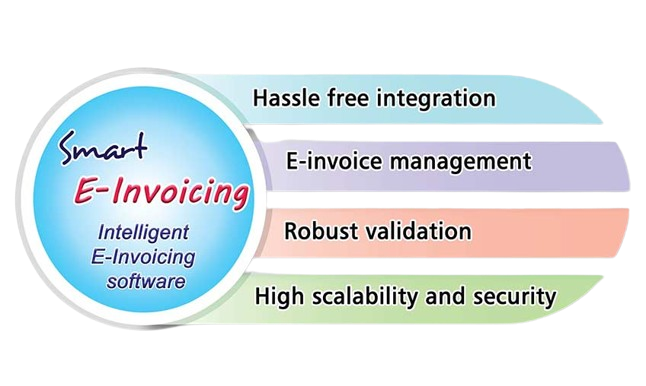

Introduction to E-invoicing

Businesses/Taxpayers with a turnover more than INR 50 crores in a financial year will have to implement the e-Invoicing process from 01st April 2021 mandatorily. Under this process, businesses have to submit documents like GST invoices, debit/credit notes, reverse change invoices, export invoices, etc. to a centralised Government portal called the Invoice Registration Portal (IRP). The IRP will validate the data in these invoices and generate an Invoice Reference Number and QR code for the same. It will digitally sign the invoice and send back an e-Invoice to the taxpayers electronically.